Private Equity Resume Guide

Contents

Contents

Introduction

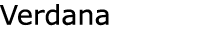

You’ve worked your way through the beginning stages of a career in private equity. The long hours and earned expertise are beginning to pay off. You may be an associate who is ready to move up to principal or a principal perched on the cusp of becoming a partner.

In these roles, your job is about to become much more strategic. Instead of managing deals from start to finish, you will be generating acquisition opportunities, stepping in at the end of deals to do the final negotiating, and conducting fundraising activities.

Private equity positions are highly sought-after and competitive jobs. You have the experience, but how do you ensure that you will get to the next level? You need to view your job search as strategically and analytically as you look at your business deals, because of all the deals you make, your career negotiations may be the most important.

This guide provides the tools you will need to create a resume that gets you noticed, but after reading, consider whether you want to spend your valuable time writing a resume or if you’d rather delegate the job to experts. If you decide you would rather take advantage of an executive resume writing service and use your time to expand your network and uncover new job opportunities, you can request a 1-on-1 consultation with one of our experienced team members.

Private Equity Careers – the Big Picture

Private equity has experienced a recent decade of growth. Not only did the number of deals grow, but the number of active private equity firms worldwide doubled and US-backed firms grew by 60 percent, according to McKinsey & Co., which also predicts that this trend will continue.

That rapid growth leaves the door open for a professional like you to rise through the ranks. But as the private equity world grows, the competition for a coveted spot in that world grows, too. You need to show that you have the ability to transition from a data-driven analytical role, most likely in investment banking, management consulting, or corporate development, into a higher-level strategic, portfolio management, and deal origination position that requires visionary thinking, high financial and emotional intelligence, and resilience to identify the deals that will net you and your company the best return.

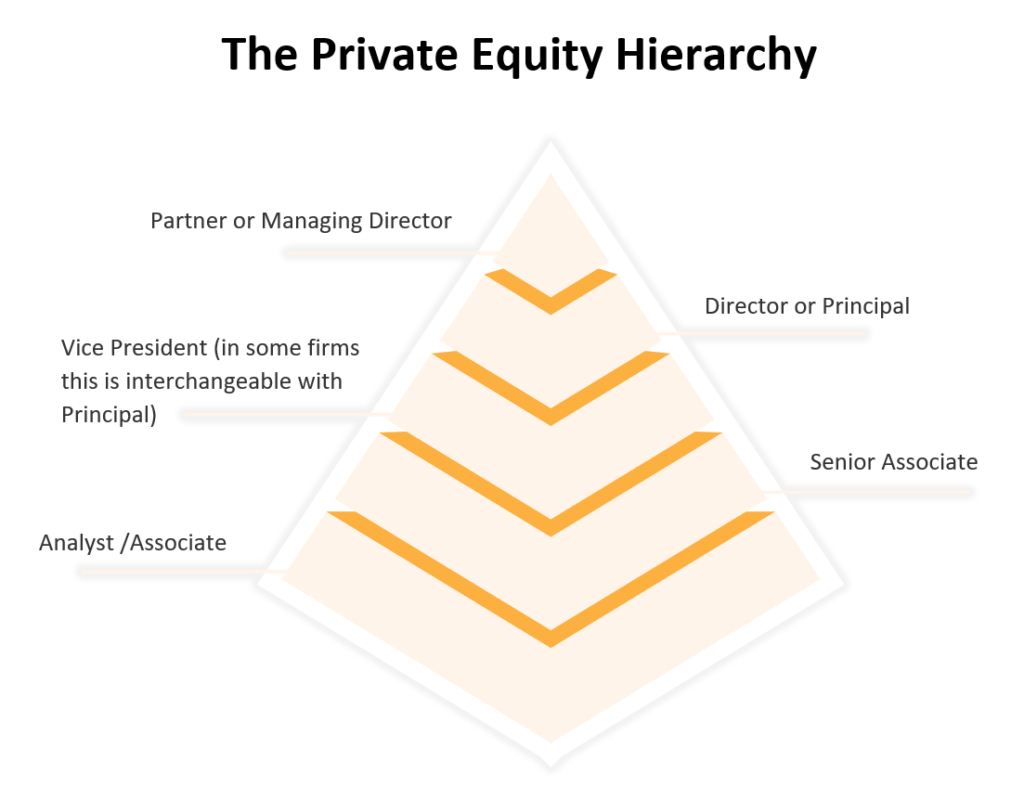

No matter how successful you have been to this point, you will need an executive resume tailored to private equity that demonstrates how you will be able to transition your skills to the next level. A decade-long survey by PrivateEquityCompensation.com indicates that more than 27% of professionals employed in venture capital and private equity secured their current position through job boards and recruiters, emphasizing the critical need for a resume that clearly depicts your career success story.

To elevate your candidacy in the eyes of private equity recruiters and hiring managers, you need a resume that:

- Provides a first impression of sustained professional, organizational, and academic excellence.

- Prioritizes your deal experience, client engagements, and individual contributions.

- Is completely free of spelling, grammatical, and formatting errors.

- Illustrates your career path and achievements in no more than two pages.

- Passes through the Applicant Tracking System (ATS) software used by most large companies.

Now, let’s discuss each section of your resume as well as design considerations.

Layout and Design of a Private Equity Resume

What image do you want to convey? As an investment executive, you have to be convincing, confident, and decisive. Your resume design must illustrate these qualities.

You’re not trying to grab a headhunter’s attention with flashy graphics or creative design. A subtle, classic approach emphasizes your professionalism. You want your accomplishments to speak for themselves, so your design should take a back seat. Here’s how to achieve that:

- Use a legible font and bold only important information and section headings.

- Leave one-inch margins and avoid big blocks of type.

- Stick to a tried-and-true format with bulleted items for each achievement and a reverse chronological order list of employment.

- Keep it to two pages and discuss only the last 10–15 years of employment history.

- Create obvious sections that are easy to find.

Good Font Choices

A well-designed resume also calls for clear titles for your section headings, bold job titles, acceptable fonts, and bulleted descriptions. It also means you should forgo a portrait picture, skip any graphics, and limit the use of color. You don’t have to strip all the personality out of your design. There is still room to show off your style within typical resume constraints. However, it’s best to save most of your creativity for the text of your resume.

The place to get creative is in your executive profile. We’ll get to that shortly, but first, let’s review another very formatted section.

Contact Information

We don’t have to tell you that your contact information is incredibly important. Your goal is to get that phone call or email that says you’ve made it past the initial screening. Make it as simple as possible for a recruiter to make contact. Keep it uncluttered and list only these elements:

- Your full name

- A phone number

- A professional email address (don’t use an AOL or hotmail address)

- Your LinkedIn profile URL

- If relevant, add your city and state, but for privacy purposes, do not include your full street address

Now comes the heavy lifting.

CYour Title and Summary

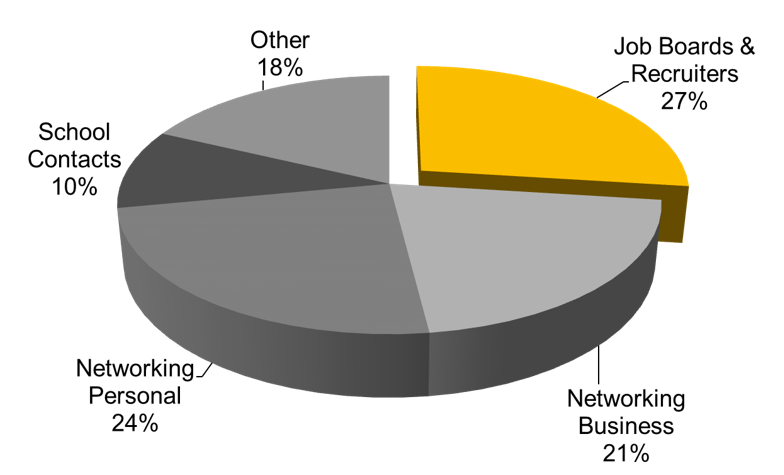

Your title is exactly that, the title of the job for which you are applying. This is an area of your resume that you may have to tweak depending on the position you are targeting. Make sure that your title matches that of the job listing.

Following your title, your executive summary is included at the top of the first page. Your summary has to convey, in just a few sentences, your Career Success Proposition™ or CSP. This includes your top accomplishments and how they prepared you for your next challenge. In a crowded field, creating a powerful CSP requires that you consider a series of thoughtful questions:

- What do I bring to the table that makes me stand out?

- What quantifiable information do I have to back up my assertions?

- How can I illustrate that I bring in high-yielding investment ideas and deals?

- How can I demonstrate the power of my network and executive communication skills?

- What experience do I have that allows me to provide immediate results?

One of the greatest problems a hiring manager discovers when sifting through hundreds of resumes is a lack of focus. Candidates often throw every conceivable piece of information onto a page and hope that the hiring manager sees the unique value that sets them apart. It’s your job to create a compelling, focused, and personal message that a prospective private equity firm can’t resist.

Your CSP serves as your thirty-second elevator speech—a concise answer to an interviewer’s question, “Tell me about yourself.” A well-crafted CSP also provides an impactful foundation for your online networking profile.

So, how do you develop your CSP? Use a three-point approach that includes specificity, scope, and strengths:

-

- Specificity. Be specific regarding your industry experience and tailor your CSP to precisely match the firm’s needs. Private equity shops want to hire a person who can hit the ground running and operate independently right away.

- Scope. Define your scope with regard to transaction size, industry deal experience, and geographical reach. Are you an East Coaster? What investment areas do you specialize in? Do you do primarily big deals? Whatever the scope of your experience, make it clear.

- Strengths. Reflect your strengths succinctly and back up every performance claim with quantifiable proof. Give examples to demonstrate your value to the firm’s hiring manager.

Remember that you don’t need to describe your entire career in this succinct paragraph. This is what sets you apart from other qualified professionals, so identify your distinguishing characteristics that will add value to a prospective firm. Assess your deal experience and your impact on financial metrics and clients.

Additionally, research the qualities and accomplishments private equity firms are looking for. Make a list of your strongest traits; those that really tell who you are. Ask close colleagues or friends to describe you in order to get an objective look at how others see you. Then incorporate the best of those traits into your summary.

You have 2–5 sentences to really sell the recruiter on your candidacy, so every word counts. Use active verbs and include specificity, scope, and strengths. Here is an example of a solid CSP statement:

Example: I am a private equity investment professional with deep M&A transaction experience. I’ve led teams in dozens of transactions ranging in size from $100 million to $1 billion in value primarily in the biotech industry.

Do you see how clear your message can be in just a couple of sentences?

Nail down your Career Success Proposition™ and you will have a clear message for your networking efforts and the core message required to create a powerful, focused summary.

Private Equity Core Competencies

This is the perfect place to add in the keywords and phrases that will get you past Applicant Tracking System (ATS) software. While ATS algorithms are sophisticated and do more than rank your resume based on the number of relevant keywords you use, you definitely need to include the skills your potential employer considers to be of high value.

The main idea here is to include the skills and attributes that the firm is seeking to fill its open role. Review specific jobs of interest and identify the skills sought by these firms. Principals and partners are dealmakers, so they must be skilled in the art of negotiation. Break that down further and you see that negotiating requires multiple skills, including soft skills such as problem-solving, communication, and persuasion. Your core competencies must include a mix of financial savvy and people skills, not only to negotiate but to maintain great relationships.

Common Phrases Found in Private Equity Job Descriptions

- Financial Analysis

- Investment Banking

- Strategic Consulting

- Financial Modeling

- Regulatory Compliance

- Negotiation

- Risk Analysis

- Mergers & Acquisitions

Take stock of all your skills, including any specific industry knowledge that may distinguish you from other candidates. Analyze the job listing and make sure you use exact phrases. If the job listing says “mergers and acquisitions,” don’t limit your language to just “M&A.” Spell it out. In fact, include both to increase your chances. Choose the skills that best represent your strengths and match the abilities sought by your firm of interest.

The next section focuses on the details of your career.

Employment History (Professional Experience)

This section takes a deep dive into your career; however, don’t get caught in the trap of listing every responsibility at every job. Once you have passed the ATS scan and a quick overview by your future employer’s human resources department, the hiring manager will be looking to see what you know and what you have accomplished so far. Your demonstrated knowledge of financial analysis, negotiations, and strategic thinking is critical.

First, eliminate jobs that are more than 10 to 15 years old unless they have a high significance in your career journey. As a private equity executive, you are at the point in your career where relevant experience is critical. Prioritize your deal listings by size, your successful client service engagements, and other individual contributions. Select your most impactful accomplishments with direct relevance to important financial metrics, client relationships, or organizational improvements.

Now for the actual writing. At the executive level, focus only on your industry-specific professional experience. For each position, start with a short paragraph describing your role and summarize your daily accountabilities and tasks.

Following this short paragraph, highlight your most significant achievements in 3–5 bullet points. Select highlights that illustrate your main successes with deals, clients, and projects. Choose these main bullets with the interview in mind and consider how you will discuss each of these achievements in more detail during a face-to-face meeting.

Additionally, use industry-specific terms such as EBITDA, hurdle rates, WACC, and NPV to demonstrate your ability to speak the language of high finance. At this level, you need to think on your feet. In your resume, provide bulleted examples that illustrate your ability to assess challenges and discover creative solutions for moving deals forward. Try using the C-A-R format for each item: Describe your challenge, the actions you took to address it, and the results you achieved. You’re in a numbers game, so make sure you use data as much as possible to bolster your assertions. Do you have relationships with clients and investors that have generated leads? What ROI figures can you highlight? Did you choose investment others overlooked? Can you explain why?

Finally, open up your thesaurus app and consider powerful adjectives and verbs that show you’re a person of action and vision.

You’ve done the heavy lifting, now you just need to document your education.

Education and Awards

Your education section will be a breeze after all the work you did on your summary and employment history. All you need to do is list your bachelor’s degree, major, and the university where you earned your degree. Then, repeat the process if you have a master’s degree and again if you have a doctorate.

Keep in mind that you are well beyond the point in your career where you need to mention your GPA.

If applicable, consider licenses, certifications, and affiliations that emphasize your knowledge and experience:

- Series 7 or Series 63 Licenses

- Financial Certifications, such as CPA, CFP, ChFC, or CFA

- Awards and Accolades

- Professional Affiliations

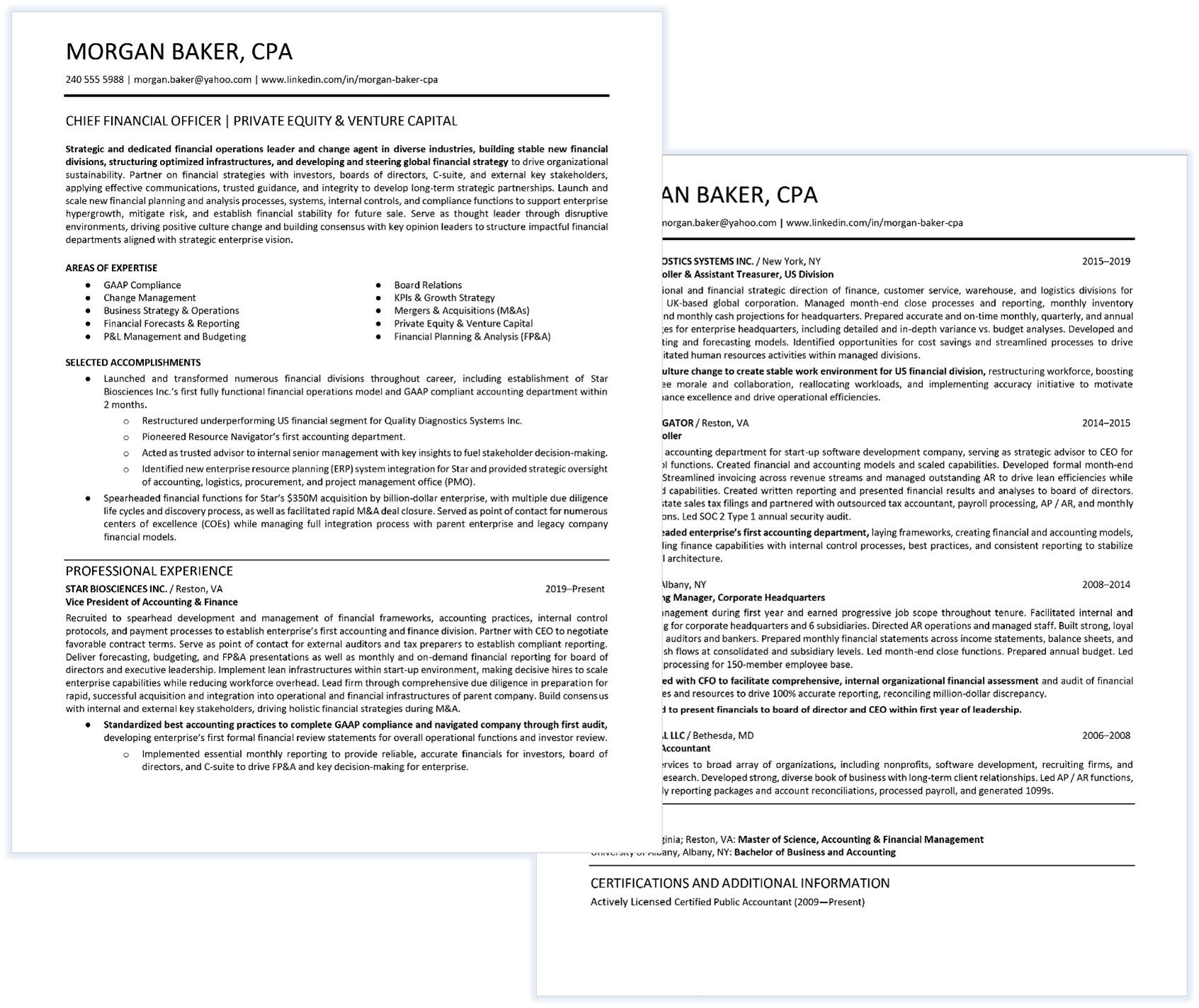

Putting it All Together – A Complete Private Equity Resume Example

You have a breakdown of everything that goes into a private equity resume, including some of the research you need to target jobs of interest. You have the actionable items you need to accomplish. Now, you need to take a step back and consider the big picture.

Examine our private equity resume example and consider how you can best represent your career in a two-page document.

As you prepare your own document, here are a few more bits of advice:

- Ask a trusted friend or colleague to read your resume over, and even better if that friend or colleague is already working in the private equity industry. The stakes are too high to lose out on an opportunity because you made a typo or committed an obvious error or misrepresentation.

- Make sure that you don’t split a section in half when transitioning from page 1 to page 2. It looks unprofessional and recruiters may miss what’s on the top of page 2.

You’re almost there.

Just one last thought: Would you hire someone with your resume? Make sure the answer is a resounding YES!

Next Steps

After reading this guide, have you calculated the time and effort it will take for you to do all this on your own? Do you want your resume to stand out from the crowd?

If you decide you would rather take advantage of an executive resume writing service and use your valuable time to expand your network and uncover new opportunities at a private equity or venture capital firm, you can request a 1-on-1 consultation with one of our experienced team members.

How We Help Professionals Like You

We work exclusively with executive-level professionals like you. By leveraging our decades of experience and our proven process, our clients get hired faster and negotiate higher compensation packages. Our approach is to uncover your unique talent brand, the things that truly make you the best candidate for an executive position.

|

Resume Writing

|

Interview Prep

|

Career Coaching

|

The Power of a Professional Executive Resume

What does your personal brand say about you? Experienced executives leverage our team of certified resume writing experts to position them as the expert in their field.

You need more than just a resume; you will also need a cover letter, LinkedIn profile, and professional biography.

Here’s what our clients are saying about our process…

“I took some time last night to review the materials and some time this morning to re-review with fresh eyes. I cannot identify one edit that I would like to make. I appreciate the time we spent upfront to go through my background. I honestly believe it paid off big time. Those conversations pushed me in ways I really needed to be pushed and I am extremely grateful.”

– Executive Leader in Large Financial Firm

“I would like to personally say thank you for all of your efforts relating to the development of my resume and other collateral (cover letter, thank you notes, etc). It’s always a pleasure to meet someone like yourself [who] is so professional and who really exhibits awesome skills in really understanding the current landscape at the senior executive level. Your ability to ‘write the story’ and present the career lifeline in a way that the reader of these documents can follow and quickly ascertain key career successes and achievements was outstanding. I also appreciated the depth of our conversation and your knowledge from a business and industrial perspective as you pursued gaining a better understanding of me as we walked [through] the materials that I provided for your review. Your attention to detail was really outstanding, [as was] your ability to [dive deep] [into] several of the elements of my background. Your guidance and advice during the process was greatly appreciated and provided me with a strong sense that the end product was going to turn out very nicely. Again, thank you so much for your efforts and the final product — superbly done!”

– Chief Executive Officer and Founding Partner

Learn why 6,000+ executives have found success with us

If you would like to learn more about how we help our clients succeed in their careers, we invite you to request a 1-on-1 consultation with one of our team members.