Hedge Fund Resume Guide

Contents

Contents

Introduction

You have a strong foundation in financial markets, investments, and banking and have worked your way into a position dealing with hedge funds. You’ve excelled in these operations by working hard and learning as you go.

Now you’re ready to move forward in your career. You haven’t chosen the easiest path. The hours have been long and the stress to exact big profits has been high, but the monetary rewards and the chance to immerse yourself in global issues and markets make the move to hedge fund management a great career choice for you.

Progressing into fund management requires deep knowledge of financial modeling, economic conditions, policy situations, and quantitative research. You won’t, though, be analyzing the day-to-day work by yourself. Instead, you will be working with research analysts and associates with top-notch quantitative skills. You will be assessing the data provided and making the big decisions to maximize alpha based on your extensive knowledge of financial markets.

Surveys show that the roles with the greatest control over investment decisions are held by professionals with the most years of experience. In order to compete with other tenured professionals, you have to successfully showcase your experience in the field. The first step is developing an executive resume that sells your financial acumen to recruiters on the lookout for top hedge fund talent. Your resume is a document that can open doors for you.

Hedge Fund Strategies

What is your specialty?

- Global macro

- Directional

- Event-driven

- Merger arbitrage

- Credit arbitrage

- Distressed debt

- Long/short

- Capital structure

- Legal catalyst

- Emerging markets

Hedge Fund Job Search – the Big Picture

An evolving market means you have to be at the top of your game, and you have to be able to adjust to investor expectations while selling them on your ability to manage your fund to peak performance.

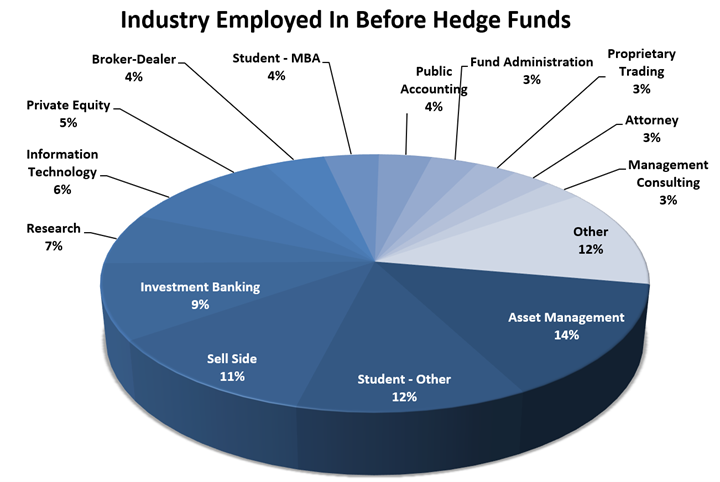

Hedge fund professionals come from a variety of backgrounds in investment banking, management consulting, private equity, and even information technology. Regardless of your background, the key to a successful hedge fund career search is to optimize your relevant skills through an executive-level resume that proves your value to investors and your firm. Your professional resume must:

- Express your professionalism, organization, and attention to detail.

- Be free of any spelling, grammar, or formatting errors.

- Create a written portrait of a hard-working, go-getter who can bring in investors and keep them happy.

- Elevate your job descriptions with strong verbs and adjectives.

- Delineate your path to success with quantitative data and details.

- Pass through the Applicant Tracking System (ATS) software used by most companies.

In this guide, we will show you exactly how to accomplish that—if you decide you want to do it on your own.

But let’s be honest: Your time is valuable. After reading this guide, if you decide you would prefer to take advantage of an executive resume writing service, you can request a 1-on-1 consultation with a professional.

Layout and Design of a Hedge Fund Resume

What image do you want to convey? As an investment executive, you have to be convincing, confident, and decisive. Your resume design must illustrate these qualities.

You’re not trying to grab a headhunter’s attention with flashy graphics or creative design. A subtle, classic approach emphasizes your professionalism. You want your accomplishments to speak for themselves, so your design should take a back seat. Here’s how to achieve that:

- Use a legible font and bold only important information and section headings.

- Leave one-inch margins and avoid big blocks of type.

- Stick to a tried-and-true format with bulleted items for each achievement and a reverse chronological order list of employment.

- Keep it to two pages and discuss only the last 10–15 years of employment history.

- Create obvious sections that are easy to find.

Good Font Choices

Avoid These Fonts

Think of it as inviting someone into your office space. You want a neat, uncluttered professional presentation. If your resume is concise and organized, the focus will turn to your achievements. If it’s distracting or contains errors, the results will not be what you are looking for.

There is one place you can channel your creativity—your executive profile. But first, while we’re talking about staying within the boundaries, let’s look at another highly formatted section.

Contact Information

Your contact information is incredibly important. Your goal is to get the phone call or email that says you’ve made it past the initial screening and they want to speak with you. Make it as simple as possible for a recruiter to make contact. Keep it uncluttered and list only these elements:

- Your name

- A phone number

- A professional email address (not your work email, of course)

- Your LinkedIn profile URL

- If relevant, add your city and state, but not your street address

Put these elements at the top of your resume like this…

Your Title and Summary

Your title is exactly that, the title of the job for which you are applying. This is an area of your resume that you may have to tweak depending on the position you are targeting. Make sure that your title matches that of the job listing. Perhaps you will have a descriptor with it such as Hedge Fund Manager–Relative Volatility.

Your CSP

Following your title, your executive summary is included at the top of the first page. Your summary has to convey, in just a few sentences, your Career Success Proposition™ or CSP. This includes your top accomplishments and how they prepared you for your next challenge. Think of this as a super-summary because while you do have to sum up your career, you have to do so in a way that shows recruiters and potential employers how you will elevate the company with your talents. You can define your CSP by taking the time to consider the scope of your expertise, the key strengths that set you apart, and the specifics of your jobs of interest. This is the elevator pitch that will intrigue the other partners in the firm and get them thinking, “We need this person on board.”

In a field crowded with capable Hedge Fund professionals, before you create your resume, you have to ask critical questions, “What do I bring to the table that makes me stand out? What is my unique mix of skill sets that can add immediate value? What experience do I bring that enables me to hit the ground running?”

One of the greatest problems a hiring manager discovers when sifting through hundreds of resumes is a lack of focus. Candidates often throw every conceivable piece of information onto a page and hope that the hiring manager sees the unique value that sets them apart. It’s your job to create a compelling, focused, and personal marketing message that a prospective employer can’t resist.

Your Career Success Proposition™ (CSP) serves as your 30-second elevator speech—a concise answer to an interviewer’s question, “Tell me about yourself.” It is also a powerful start for your online networking profile.

Developing Your Own Career Success Proposition™

So, how do you develop your CSP? Use a three-point approach that includes specificity, scope, and strengths.

Specificity. Be specific regarding your industry experience and tailor your CSP to precisely match their needs. Firms want to hire a person who can hit the ground running, not someone they need to educate on the industry.

Scope. Define your scope with regard to product or service expertise, transaction size, and geographical reach. Are you an East Coaster? What investment areas do you specialize in? Do you do primarily big deals? Whatever the scope of your experience, make it clear.

Strengths. Reflect your strengths succinctly and back up every performance claim with quantifiable proof. Give examples to demonstrate your value to the firm’s hiring manager.

To be most effective, refine your statement into two or three sentences. Use active verbs and include specificity, scope, and strengths. Here is an example of a solid CSP statement:

I am a hedge fund investment professional with an MBA from Carnegie Mellon and deep portfolio management experience based in Manhattan. My success has been in interest-rate and foreign exchange trading, and in developing trading strategies based on both macroeconomic and quantitative models.

Do you see how clear your message can be in just a few sentences? Nail down your Career Success Proposition™ and you will have a clear message that can be used for your networking efforts and also serve as the core message required to create a powerful, focused resume.

Now that you’ve created a well-defined CSP, how do you build on it to craft a compelling executive summary? Hedge fund strategies have traditionally been diverse with the dominant strategy dependent on market forces, so your personal brand must include a combination of market-based expertise, decision-making skills, and analytical aptitude.

Next, consider your biggest career wins. Think about all the professional steps you took to get you where you are today. Detail each of these successes in one or two sentences. Include impressive data that backs up your assertions. You are projecting an image of a hard-working, thoughtful, go-getter, and your words should help build that impression. Use strong verbs to convey action.

Additionally, as a hedge fund manager, you will be bringing in investors, so explain how you do that. Describe your network of contacts and your method of expanding it. How do you sell those contacts on your services?

Finally, synthesize your hedge fund management philosophy and style. Do some research to find out what firms are looking for in your market during these economic times and highlight relevant skills.

Here are some tips and reminders for your summary section:

- You are not telling the tale of your entire career. Hit the high points. Save the details for the interview.

- Make sure you clearly state what you will bring to the team based on the needs of the firm.

- Show that not only can you manage a fund but that in your current role you are already functioning as a hedge fund manager. If you are a hedge fund manager, show that you are ready to move up.

- Ask a trusted colleague what words they would use to describe your professional personality and philosophy. An objective opinion may give you a fresh idea.

Now, let’s explore your key skills that best align with the qualifications required by your jobs of interest.

Hedge Fund Core Competencies

This is the perfect place to add the keywords and phrases that will get you past Applicant Tracking System (ATS) software. While ATS algorithms are sophisticated and do more than rank your resume based on the number of relevant keywords you use, you definitely need to include the skills your potential employer considers to be of high value.

Common Hedge Fund Job Description Phrases

- Hedge Fund Operations

- Complex Reasoning & Problem Solving

- Team Collaboration

- Financial Modeling

- Leadership Skills

- Financial Analysis

- Systems Development

- Risk Management Technology

At a glance, your core competencies say a lot about your qualifications as a hedge fund manager. When you choose the key skills and accomplishments to highlight, you are revealing not only what you bring to the table, but what you believe to be the most important attributes for a hedge fund manager to have.

So, what are the key attributes a hedge fund manager needs?

First, let’s look at the hard skills or knowledge you acquired through school, research, and on-the-job hedge fund training.

- Deep understanding of analytical finance.

- Thorough knowledge of specific businesses and industries.

- Ability to dig deep into market research.

- In-depth grasp of financial instruments and strategies.

- Clear vision of risk factors and strategic alternate plans.

- Roadmap for constructing portfolios.

- Ability to model just about anything using software tools such as Excel, Matlab, and Python.

As a hedge fund manager, your abilities need to extend beyond assessing the dependencies of mathematical calculations or performing scenario analyses. In the executive suite, your soft skills are just as important as your industry expertise. It’s doubtful you would have gotten this far without those hard skills, but your soft skills are a big part of what’s needed now.

Here are some necessary soft skills and attributes for a hedge fund manager:

- Risk tolerance: This may be the most important. You must have the temperament to take weighed risks, including understanding the chances of a risk turning in your favor.

- Ability to judge character: You will be responsible for the work of others and must be able to trust their conclusions.

- Communication skills: You need to be able to accurately convey your strategies, plans, and ideas to both your team and your investors.

- Organization: Keeping track of the market, your businesses, your transactions, and your investors requires keen organization.

- Marketing: Why should an investor hand over funds to you and how do you get them interested in the first place?

- Leadership: You want your team to work hard for investors, so you need to know how to keep them motivated and how to show you’re listening to their analyses.

After considering these hard and soft skills, scan the listing for your job of interest to identify the most important skills required by your potential employer. Match these desired skills with your own competencies. Choose 6 to 10 of these attributes and add a word or two of detail to differentiate yourself in the eyes of recruiters. Offer a balance of the hard and soft skills that paint the best portrait of you and your abilities.

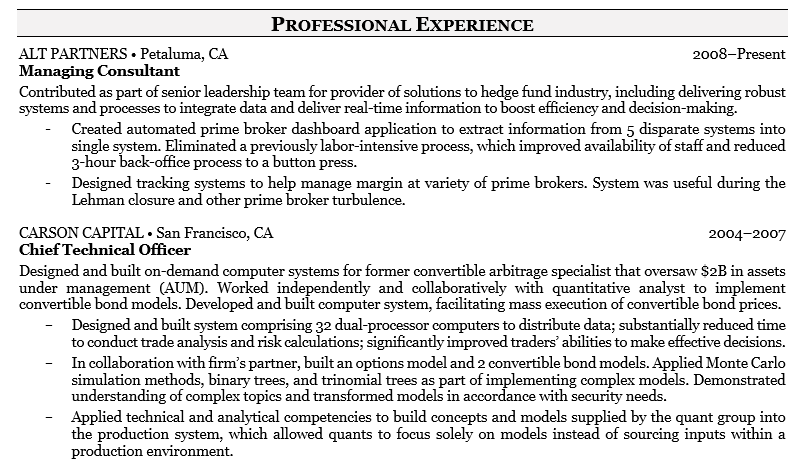

Professional Experience

Now, let’s review the bulk of your executive resume: your work experience.

First and foremost, your executive resume needs to convey why you are the right person for the job. That means a more strategic approach than simply naming your previous and current position and listing responsibilities in a list of endless bullet points.

Research indicates that hedge fund firms are no strangers to high turnover, and approximately two-thirds of hedge fund professionals have tenures of 5 years or less with their respective firms. But just because a firm is evaluating new candidates, it doesn’t mean that the professionals waiting to be interviewed are new to the industry. It’s important to remember that you will be competing with seasoned hedge fund managers, so your professional experience needs to convey your ability to best meet the firm’s unique needs.

The professional experience section must strategically highlight the progression of your career over the past 10 to 15 years. Start with your current job and ask yourself the following questions:

- How can I showcase my unique knowledge and abilities through my accomplishments?

- What data do I have to prove my point? Quantifiable achievements are important.

- How do I demonstrate my ability to sign new investors? To network?

You need to show agility, including the ability to play to your audience. Numbers rule in the hedge fund game, so go heavy on the data and dollars.

Remember that you have a mere two pages total for the entire resume, so avoid wordiness. Develop detailed descriptions of all the jobs you’ve had in the past 10 to 15 years. Then, eliminate duplicate responsibilities to save space. Include only the tasks and achievements that will move you closer to your goal.

Use the CAR Method for Your Bulleted Items

- Describe your work Challenge.

- Explain the Action you took.

- Point out the Results you achieved.

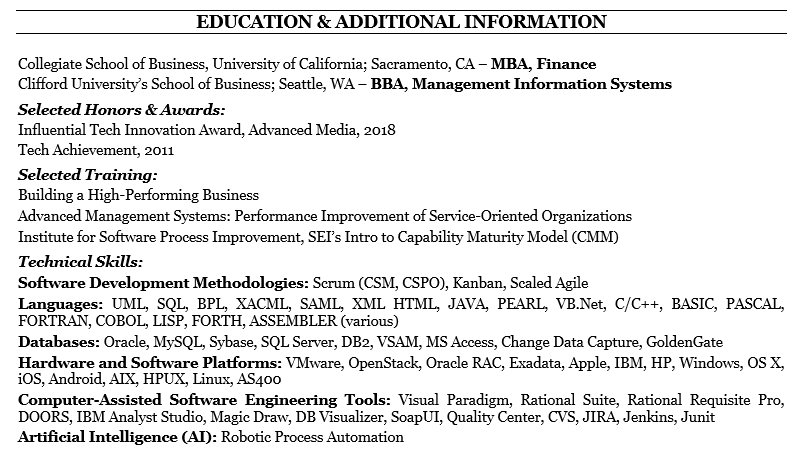

Education and Awards

The education section details your education and accolades. At this point in your career, your GPA is moot. What counts is your experience.

Sure, you may get a bump if you went to a prestigious university (or a school where someone else in the firm is an alum), but you are really just showing that you had the smarts and work ethic many years ago.

If you have earned a CFA or CAIA certificate, this is the place to include those.

Other considerations for this section are professional publications, industry awards, or relevant affiliations.

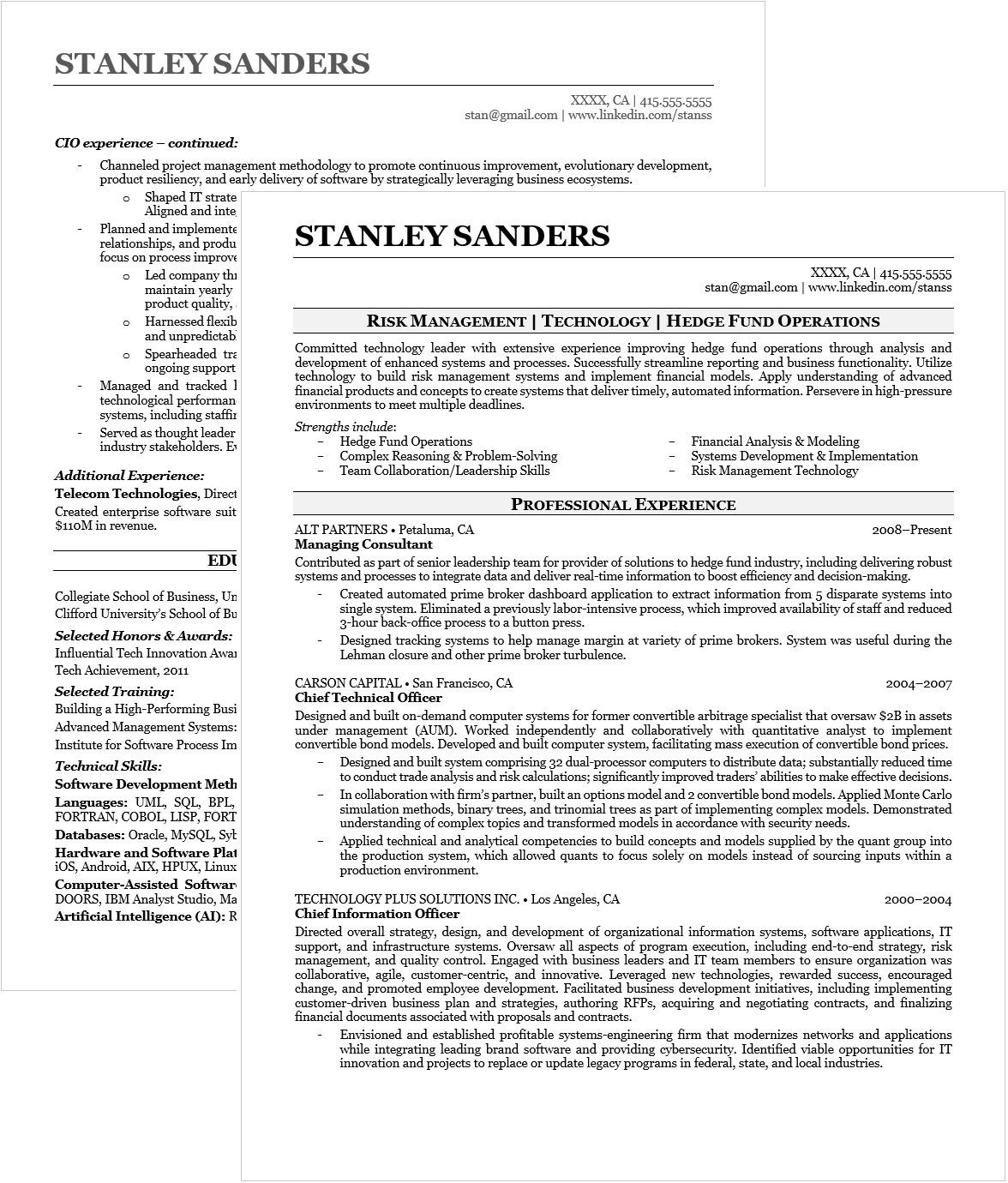

Complete Hedge Fund Resume Example

Did you work on each section individually? If so, the pieces of your hedge fund manager’s resume are all there.

Now, it’s time to compile and perfect it. Peruse our hedge fund manager resume for a glimpse of a professionally completed example.

Before you move on, here are a couple of other important hints:

- Even professional editors use editing software, so you should do the same. Proofread, edit, use spell check, and look over the formatting. Then, have a trusted colleague or friend do the same.

- Try to avoid splitting a section in two. If you must, repeat the section heading at the top of the second page.

Finally, likely you’ve done your fair share of hiring. So, ask yourself, would you hire someone with your hedge fund resume? If the answer is not a clear “yes,” then go back and make the necessary updates based on the earlier sections.

Next Steps

Did reading and absorbing the information in this hedge fund resume guide take longer than you expected? Doing all the work to create a compelling resume will take much longer. You might consider delegating the task to the resume writing experts.

We invite you to request a 1-on-1 consultation with one of our expert resume writers and let us help you land that hedge fund interview.

How We Help Professionals Like You

We work exclusively with executive-level professionals like you. By leveraging our decades of experience and our proven process, our clients get hired faster and negotiate higher compensation packages. Our approach is to uncover your unique talent brand, the things that truly make you the best candidate for an executive position.

|

Resume Writing

|

Interview Prep

|

Career Coaching

|

The Power of a Professional Executive Resume

What does your personal brand say about you? Experienced executives leverage our team of certified resume writing experts to position them as the expert in their field.

You need more than just a resume; you will also need a cover letter, LinkedIn profile, and professional biography.

Here’s what our clients are saying about our process…

“I took some time last night to review the materials and some time this morning to re-review with fresh eyes. I cannot identify one edit that I would like to make. I appreciate the time we spent upfront to go through my background. I honestly believe it paid off big time. Those conversations pushed me in ways I really needed to be pushed and I am extremely grateful.”

– Executive Leader in Large Financial Firm

“I would like to personally say thank you for all of your efforts relating to the development of my resume and other collateral (cover letter, thank you notes, etc). It’s always a pleasure to meet someone like yourself [who] is so professional and who really exhibits awesome skills in really understanding the current landscape at the senior executive level. Your ability to ‘write the story’ and present the career lifeline in a way that the reader of these documents can follow and quickly ascertain key career successes and achievements was outstanding. I also appreciated the depth of our conversation and your knowledge from a business and industrial perspective as you pursued gaining a better understanding of me as we walked [through] the materials that I provided for your review. Your attention to detail was really outstanding, [as was] your ability to [dive deep] [into] several of the elements of my background. Your guidance and advice during the process was greatly appreciated and provided me with a strong sense that the end product was going to turn out very nicely. Again, thank you so much for your efforts and the final product — superbly done!”

– Chief Executive Officer and Founding Partner

Learn why 6,000+ executives have found success with us

If you would like to learn more about how we help our clients succeed in their careers, we invite you to request a 1-on-1 consultation with one of our team members.